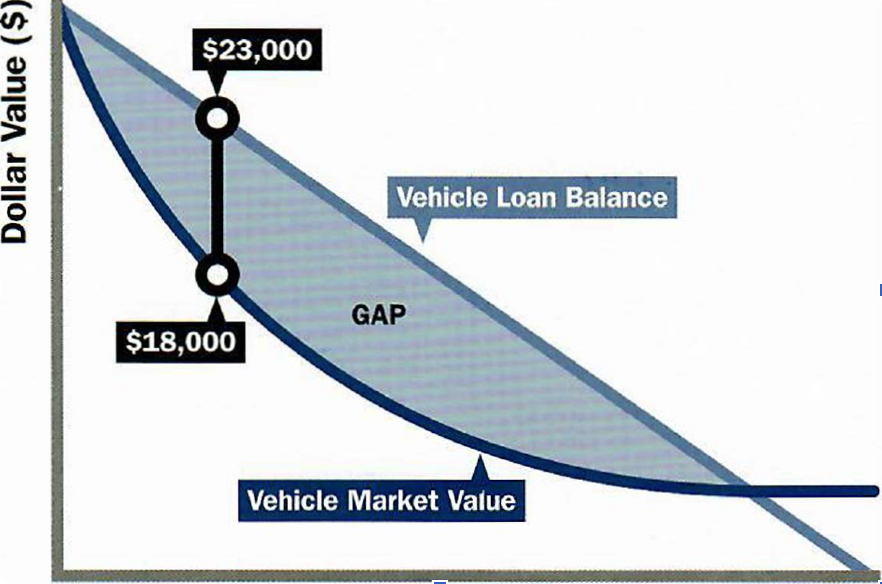

If you’re like many Americans, you might consider taking out a loan when you buy a new car. Like most of us, you also probably think that if your new car costs $25,000, it is still worth $25,000 the next day when you show it to your friends. Well, you might want to think twice, because the minute you drive your car off the car dealer’s lot, it depreciates in value. Within a few short weeks, you may have a pretty large gap between the amount you paid and the actual value of your car. Simply put, gap insurance is meant to protect you from that difference in value.

What is Loan/Lease Gap Coverage?

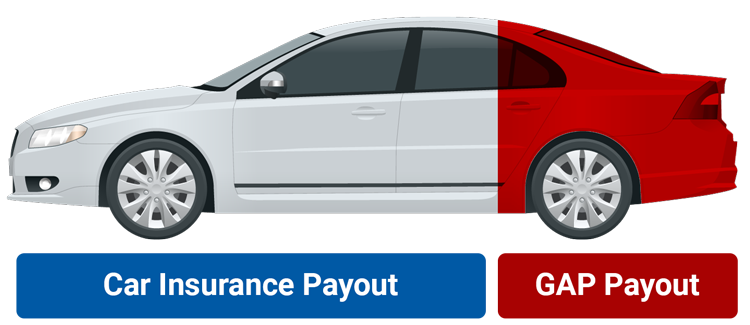

Guaranteed auto protection, also known as Gap Insurance, covers the gap between what you owe on a car and the actual cash value if your car is totaled or stolen in a covered loss. For example, imagine you take out a loan on a vehicle you paid $30,000 for, and due to depreciation, just 3 weeks later, it’s now worth $24,000. Now imagine your neighbor is in a rush and quickly backs out of their driveway without paying attention… right into your new ride… After the dust settles, the insurance company says your car is only worth $24,000, even though you just paid $30,000 for it three weeks ago! That’s where loan gap insurance coverage comes into play. It will cover the remaining $6,000, so you can pay off the rest of your loan and get a new car to replace the one your neighbor totaled. With a car lease, the same principle applies; your car may be worth less than the lease amount. Just remember that gap coverage is not a substitute for your regular car insurance policy; it is additional coverage that can be added to your policy.

When Do You Need Gap Insurance Coverage?

When you take out a loan or lease a new vehicle, you may need gap coverage since most vehicles depreciate in value—rather quickly—from the moment you leave the dealership. Typically, a car depreciates in value by approximately 30% within three months of purchase! If your car is totaled in a covered loss, you’ll have to pay out of your own pocket the difference between what you owe and what your vehicle is worth on that day. Gap coverage will close that gap. You may not need GAP if you make a large down payment on your vehicle, as the value of the car may not be more than the value of the loan or lease. You do not need Gap insurance if you paid cash for your car.

What Can Gap Insurance Do?

Let’s say you swerve to avoid a deer and end up driving down an embankment and total your car. Although no one’s hurt, the cost to repair your vehicle is higher than its actual cash value (ACV). Your insurance company determines the ACV to be $20,000. If you have a $500 deductible, your insurance company will pay $19,500 to settle your claim. You bought your car a few weeks earlier for $24,000 and haven’t even made the first payment yet, so you will still owe the full amount to your lender. You are responsible for paying the remaining $4,500 to your lender. Gap coverage will pay the $4,500, which includes your deductible, but be aware that not all Gap policies cover your deductible.

How Do You Buy Gap Insurance Coverage?

You buy gap coverage at the time you purchase or lease the new vehicle in either of two ways. You can ask your independent insurance agent to add Gap to your car insurance policy, or you can ask the finance/leasing company. Generally, the cost might be higher if the coverage is purchased within the finance agreement because you are paying for the coverage plus some fees. The price the finance company can charge is not regulated, but the cost of the coverage through your auto insurance policy is regulated by the state. Often, leasing companies include Gap coverage in their contracts; make sure you review your lease contract so you don’t pay twice.

What to Look for When Purchasing Gap Insurance

Gap insurance coverage is similar from insurance company to insurance company. However, you should check with your independent insurance agent, as there are potential exclusions and limitations, such as:

- Overdue lease/loan payments

- Security deposits not refunded by the lessor

- Costs for extended warranties

- Deductions for wear and tear, prior damage, towing, and storage

- Equipment added by the buyer

What Should You Do?

As your independent insurance agent, Stonewall Insurance works to find you the best coverage at the most competitive rates. Contact us when you decide to purchase a car, and we will help you decide whether you need gap insurance. We take great pride in providing professional customer service to you as we handle all your insurance needs.

0 Comments